Pay Less in Taxes,

Save More for Health

with a Self-Directed HSA

An HSA offers a smart way to manage healthcare costs with a unique “triple tax advantage.” You contribute pre-tax dollars, your savings grow tax-free, and withdrawals for qualified medical expenses are also tax-free. Many HSAs even allow you to invest your funds for potential growth. Explore the benefits of an HSA and see how it can work for you.

Contributions are

Tax-Deductible

Investments grow

Tax-Deferred

Eligible Expenses are

Tax-Free

HSA

for Investing

$195 Annual Membership

Contributions are tax-deductible, earnings grow tax-free, and withdrawals for qualified medical expenses are also tax-free.

A key feature of a self-directed HSA is the ability to invest in a wider range of assets beyond traditional options, potentially leading to greater long-term growth. This allows account holders to build wealth for future medical needs while having tax-free access to funds for current qualifying expenses.

Pair your investable self-directed Health Savings Account with an HSA Visa® Debit Card to take care of qualifying medical expenses with ease.

HSA

for Medical Expenses

$75 Annual Membership

Simplify how you pay for eligible healthcare costs with the convenience of an HSA-linked Visa® Debit Card.

Contributing to this account offers a valuable tax benefit, as your contributions are fully tax-deductible, directly lowering your taxable.

The debit card allows for seamless transactions when paying for a wide array of qualified medical expenses, from doctor’s visits and prescriptions to other eligible healthcare services.

Any funds you don’t use will roll over into the following year. This feature enables your healthcare savings to accumulate over time.

Eligibility

Eligibility to open a Health Savings Account (HSA) includes being covered under a High-Deductible Health Plan (HDHP compatible) on the first day of the month, not enrolled in Medicare, not claimed as a dependent on someone else’s tax return, and have no other health coverage except what is permitted under Other Health Coverage from IRS Publication 969.

Qualifying Tax-Free Expenses

With a Health Savings Account, you can pay for qualifying medical expenses completely tax-free, such as: Prescriptions, eyeglasses/contacts, dental services, chiropractic services, ambulance services, COVID-19 related testing and treatment & more. See the full list on IRS Publication 502.

Coverage Options

Individual Coverage

The policy covers the individual.

Annual Contribution Limit

$4,300 (under age 55)

$5,300 (55+)

Family Coverage

The policy covers the family.

Annual Contribution Limit

$8,550 (under age 55)

$9,550 (55+)

Have Questions?

FAQs

An HSA is a tax-advantaged savings account designed for individuals with a high-deductible health plan (HDHP). It allows you to save pre-tax dollars and use them for qualified medical expenses tax-free, with unused funds rolling over year to year.

To contribute to an HSA, you must be enrolled in an HSA-qualified HDHP, not covered by other non-HDHP health plans, not enrolled in Medicare, and not claimed as a dependent on someone else’s tax return.

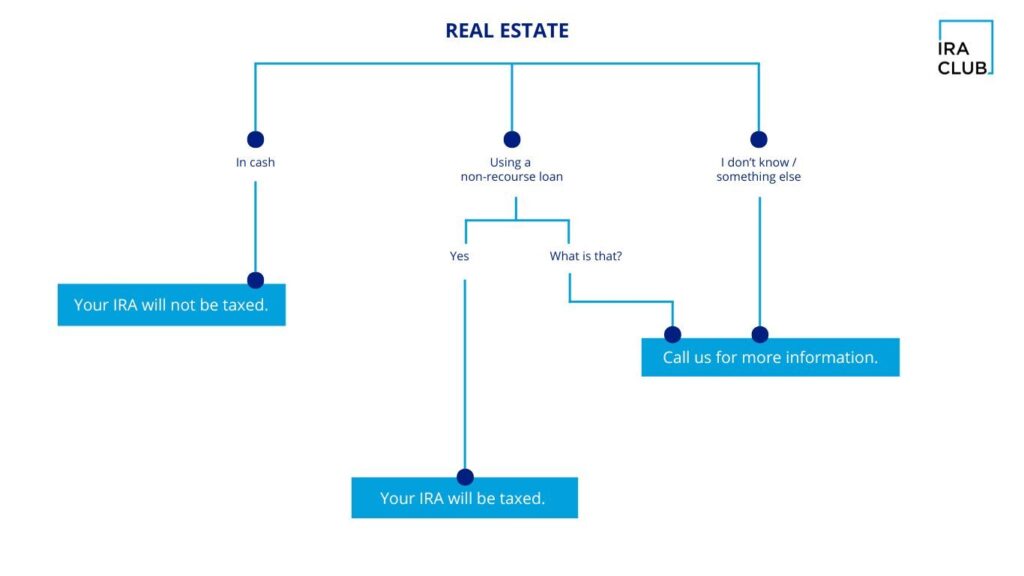

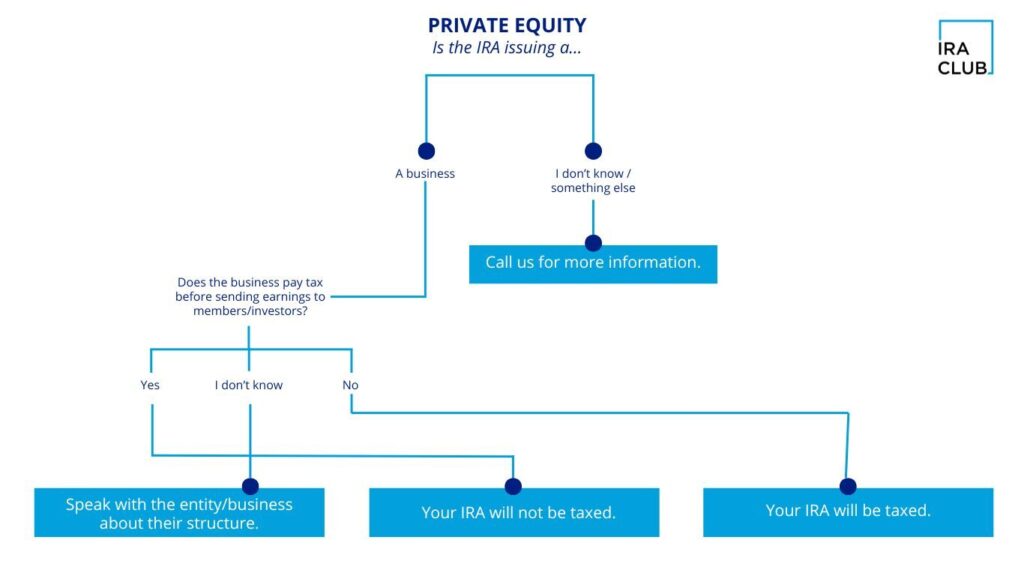

Yes, many HSAs allow you to invest your balance in both the stock market and alternative investments like real estate, potentially growing your savings over time.

You can use HSA funds for a wide range of qualified medical expenses, including doctor visits, prescriptions, dental and vision care, and some over-the-counter items.

Yes, you can have both HSA account types, just keep in mind they are two separate accounts with their own fee schedules and not one joint account.

DISCOVER ALTERNATIVE OPTIONS

Investor's Row

Discover alternative investment opportunities for your Self-Directed Health Savings Account (HSA).