Maximize Your Retirement Savings

with a Solo 401k

IRA Club’s Solo 401(k) plans put self-employed individuals like you in the driver’s seat with higher contribution limits, tax-advantaged growth potential, and the flexibility to invest on your terms.

Who Can Take Advantage of a Solo 401(k)

Independent

contractors

Freelancers

Sole proprietorship

businesses

C Corp, S Corp, LLC, and DBA

What is a

Solo 401(k)?

A Solo 401(k), also known as an Individual 401(k) or a Self-Employed 401(k), is a retirement savings plan designed for self-employed individuals and small business owners who do not have any employees, other than a spouse to make higher contributions to their retirement plan than a traditional 401(k).

Do I Qualify?

If you:

- Are you an individual who is self-employed with for-profit business activity that serves as the business sponsoring the plan.

- Do not have any common law employees besides yourself and a spouse.

The Benefits at a Glance

Higher Contribution Limit

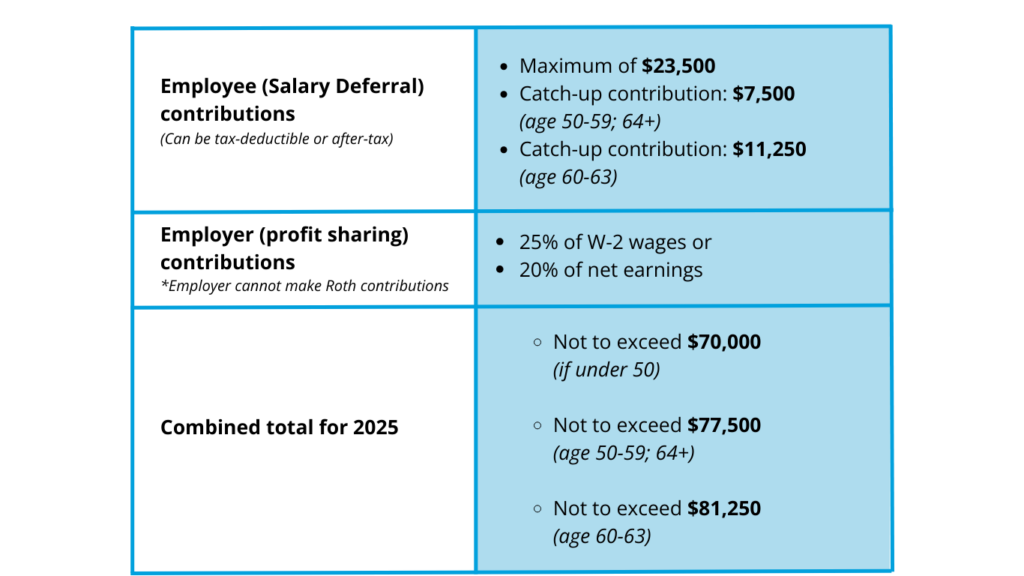

With the Solo 401(k), the account holder can make contributions as the employer and the employee, giving a much larger maximum amount.

Checkbook

Control Ability

If a checkbook control LLC is opened, Solo 401(k) account holders have checkbook ability allowing them greater flexibility in managing their retirement funds.

Loans to

Yourself

The plan participant can borrow up to the lesser of $50,000 or half of the account balance and typically must be paid back in 5 years amortization.

Exemption

from UDFI

Unlike an IRA, UDFI tax on leveraged investments are exempt with a Solo 401(k), leaving a higher yield of net proceeds from the account investments.

Expert Help from Real Humans

We mean it when we say we’re here for you. Get expert plan consulting during setup whether you’re interested in a custodial Solo 401(k) or a Solo 401(k) with checkbook control.

Solo 401(k) Fee Structure:

Custodial Solo 401(k)

Membership

$395

Account opening & annual membership.

$195

Per holding annually.

Solo 401(k) with Checkbook IRA LLC Membership

$395

Account opening & annual membership.

$325

Annual LLC holding.

$995

Checkbook IRA LLC one-time set up.

Effective 4/01/2024, please note that each account must maintain a minimum $500 cash balance. Should the cash balance fall below the minimum required, a $100 low balance penalty will be charged at the time of renewal. Fees are automatically deducted from the account, and members may opt to charge fees to a credit or debit card.

Which Retirement Account is Right For Me?

*Additional one-time and transactional fees might apply on top of annual membership.

Why Trust IRA Club?

Navigating IRS rules can feel overwhelming, but you’re not alone.

- Expert Guidance: Each client receives an IRA Club representative to ensure your 401(k) remains compliant every step of the way

- Proactive Updates: Stay informed about regulatory changes and best practices to safeguard your retirement account.

- Peace of Mind: With our team on your side, you can focus on building your financial future without worrying about the fine print.

FAQs

Investment flexibility, direct control, and efficient transactions.

To be eligible you must be self-employed or own a small business with no full-time employees, except for your spouse.

Any type of business structure is eligible, including sole proprietorships, partnerships, corporations, and LLCs.

A Solo 401(k) and a Self-Directed SEP IRA both cater to self-employed individuals and small business owners, but they differ in several key ways. The Solo 401(k) allows for both employee and employer contributions, offering higher total contribution limits and the option for Roth contributions, along with a loan provision. In contrast, a Self-Directed SEP IRA only allows employer contributions, lacks a loan provision, and typically has simpler administrative requirements with no annual filing regardless of account size. The Solo 401(k) is suitable for those seeking higher contribution limits and more control over investments, while the Self-Directed SEP IRA is ideal for those prioritizing simplicity and lower administrative burden.

A Solo 401(k) offers a wide range of investment options, enabling you to tailor your investment strategy to your specific goals and risk tolerance. You can invest in traditional assets like stocks, bonds, ETFs, and even A.I Trading portfolios powered by iFlip. Additionally, alternative investments such as real estate, private equity, precious metals, cryptocurrencies, tax liens, and private loans are permitted. Overall, a Solo 401(k) provides considerable flexibility to create a diversified retirement portfolio aligned with your investment goals and risk tolerance.

You will be able to have your own checking account, if you open a Checkbook LLC.

You can open your Solo 401(k) account here.

Funding a Solo 401(k) involves making contributions from your self-employment income, which can be done in two main ways: employee deferrals and employer contributions. As an employee, you can contribute up to $23,000 in 2024 (or $30,500 if you’re age 50 or older due to catch-up contributions). Additionally, as the employer, you can contribute up to 25% of your compensation, with total contributions (employee plus employer) not exceeding $69,000 in 2024 (or $76,500 if including catch-up contributions). These contributions can be made from your business’s earnings and can be deposited into the Solo 401(k) checking account, ensuring they are properly recorded and managed for tax purposes.

- To transfer funds from another retirement account to a Solo 401(k), you need to initiate a rollover process. Start by ensuring your Solo 401(k) is established and ready to receive funds. Then, contact the administrator of your existing retirement account to request a direct rollover, where the funds are transferred directly to the Solo 401(k) plan, or an indirect rollover, where you receive the funds and deposit them into the Solo 401(k) within 60 days. Ensure the transfer is properly documented and report the rollover on your tax return to maintain the tax-deferred status of your funds.

To start a Solo 401(k), first determine your eligibility as a self-employed individual or small business owner with no employees other than a spouse. Next fill out or online application. Complete the required paperwork to establish the plan, including obtaining an Employer Identification Number (EIN) for the Solo 401(k). Set up a designated checking account for the plan, then fund the account through contributions from your self-employment income. Finally, ensure you understand and comply with ongoing administrative requirements, such as annual filing (form 5500) if plan assets exceed $250,000. This will be handled by IRA Club on your behalf. You can click here to establish your account.

A Self-Directed IRA LLC is a self-directed retirement account that grants investors unparalleled control and flexibility over their investment decisions. By leveraging the unique structure of an LLC, this specialized IRA eliminates the need for third-party approvals for each transaction, empowering you to act quickly and confidently.

Key Features of a Checkbook IRA

- Direct Control: Manage investments independently without relying on custodians for transaction processing.

- Diversified Investments: Access a wide range of alternative assets like real estate, startups, and private equity.

- Efficient Transactions: No waiting—write checks, transfer funds, and make payments directly through your IRA LLC.

- Support from IRA Club: Comprehensive guidance to set up and maintain your IRA LLC in compliance with IRS regulations.

- Banking Benefits:

- A physical checkbook for instant payments.

- Debit card access for IRA-related expenses.

- Online banking with mobile check deposit features.

- FDIC insurance on cash balances.

- Free ACH and wire transfers for transactions up to $100,000.

- No Hidden Fees: Enjoy zero monthly fees for accounts with balances above $500.

How Does It Work?

- Setup: Establish your IRA LLC with the guidance of IRA Club.

- Funding: Your IRA contributes funds to the LLC, which then operates as a separate entity with Meridian bank.

- Investing: Use the checkbook or debit card tied to the LLC account to invest in opportunities like real estate, private equity, or crowdfunding ventures.

Why Choose a Checkbook IRA?

- Control: Gain complete autonomy over your investments.

- Flexibility: Diversify your portfolio with alternative assets.

- Speed: Eliminate delays by managing funds directly.

- Efficiency: Maintain tax-deferred growth while streamlining your investment process.

Important Considerations

Managing a Checkbook IRA requires diligence and strict adherence to IRS regulations. Avoid prohibited transactions, and ensure that all expenses are paid directly from the LLC account.

For investors who prefer less hands-on management, a traditional Self-Directed IRA might be a better fit. The IRA Club is here to guide you through the pros and cons of each option based on your goals.

Who qualifies: 4 max (including owners and their spouses)

Eligibility: Immediate or 12-months (1,000 hours) of service

Employee contribution: Pretax and Roth (optional Mega backdoor roth)

Employer contributions: Profit sharing

Vesting: Full & immediate

Loans: Are Permitted

In-service withdrawals: Available to participants over age 59.5

Salary deferral contribution: Up to $23K in 2024

Profit-sharing contribution: Up to 25% of income for corporations or 20% for self employed

Annual limit per participant: 100% of salary or $69K

Catch-up contributions (age 50+): $7,500