We know that choosing a new administrator is a big decision. We’re IRA Club – the SDIRA administrator that prioritizes your needs and financial goals.

- Personalized Service: We know you’re not just another account number. At IRA Club, you’ll receive dedicated, personalized service from our experienced team. We’re here to guide you through every step of your SDIRA journey.

- Transparent, Flat Fees: Are you tired of hidden fees and confusing pricing structures? IRA Club has straightforward, low flat fees, so you always know what to expect.

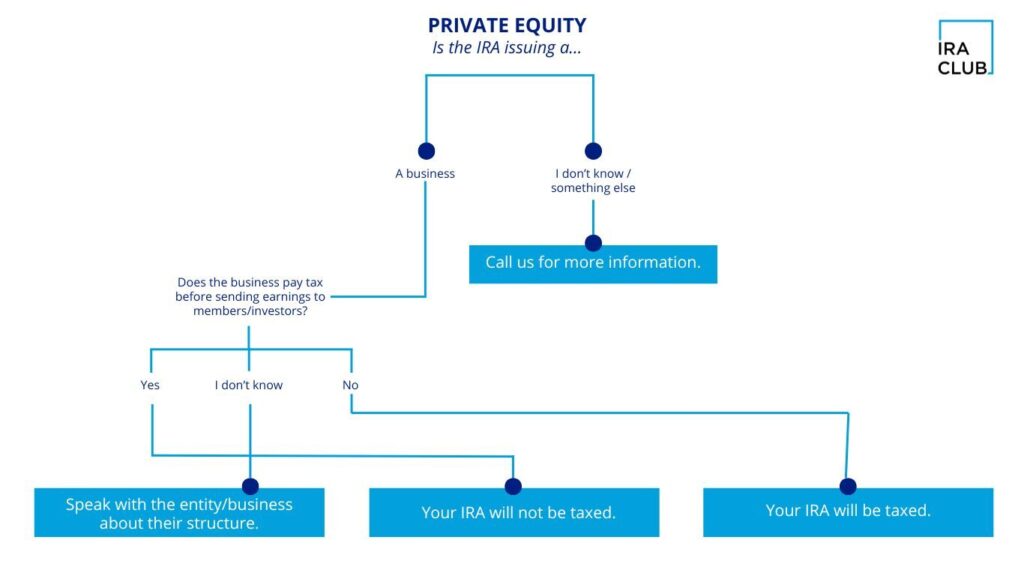

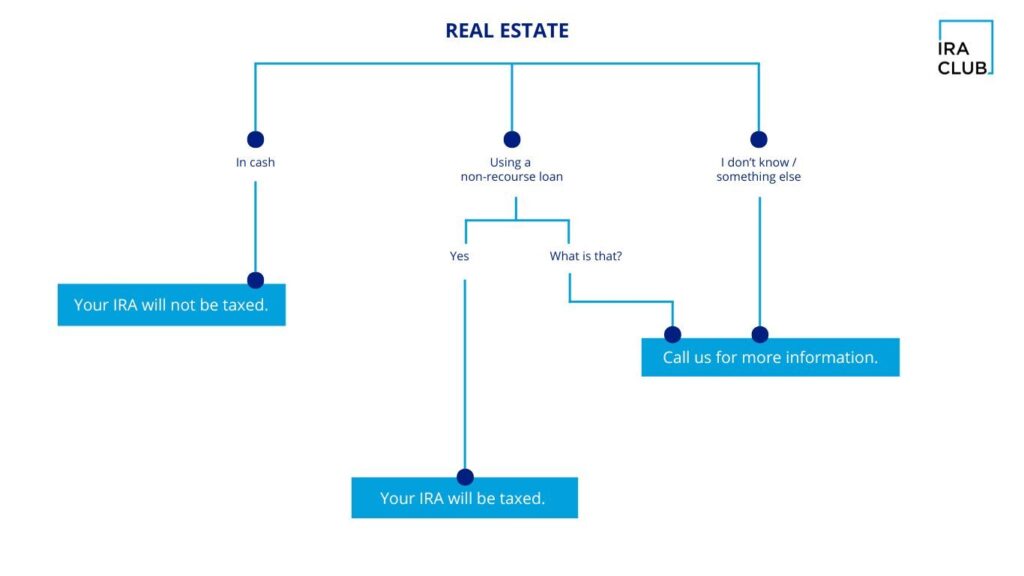

- Wide Range of Investment Options: Your SDIRA should reflect your unique investment strategy. With IRA Club, you can invest in diverse assets, including real estate, precious metals, private equity, and more.

- Online Portal: Managing your SDIRA shouldn’t be a hassle. Our user-friendly online platform makes it easy to track your investments, access important documents, and stay informed about your account.

- Seamless Transition: We understand that switching administrators can be a headache. That’s why we’ve streamlined our onboarding process to make your transition to IRA Club as smooth as possible.

Make the Switch Today

Don’t let uncertainty about your SDIRA prevent you from achieving your financial goals. Choose IRA Club and experience the difference a dedicated, client-focused administrator can make. Contact us today to learn more and start your seamless transition.

Your financial future is important to us. Choose IRA Club and discover the peace of mind you deserve.