Fueling Your Future: Diversified Growth Strategy for IRA Portfolios

May 20th, 2025 1:00 PM CT

Understand how you could maximize your IRA’s growth in the energy sector by leveraging the opportunity to participate directly in oil and gas production at the wellhead and in frac sand oilfield services, while potentially eliminating unrelated business taxable income (UBTI).

Jay Young

Ramez Fakhoury

Complete this form to receive a signed copy of King’s Founder & CEO Jay R. Young’s book The Upside of Oil & Gas Investing

Founded

In 2008

Members

Administered

1 Billion

in Assets

Full-Time

Dedicated Staff

White-Glove

Service

Here’s What You’ll Learn

1

2

Understand how the King program’s diversification could lead to enhanced growth.

3

Direct participation in oil and gas at the wellhead coupled with frac sand oilfield services.

4

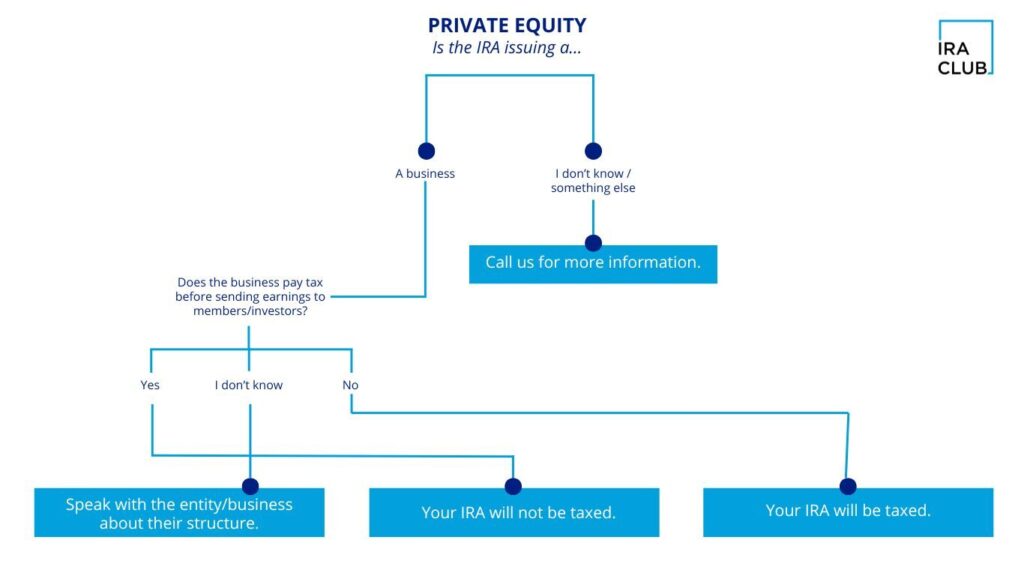

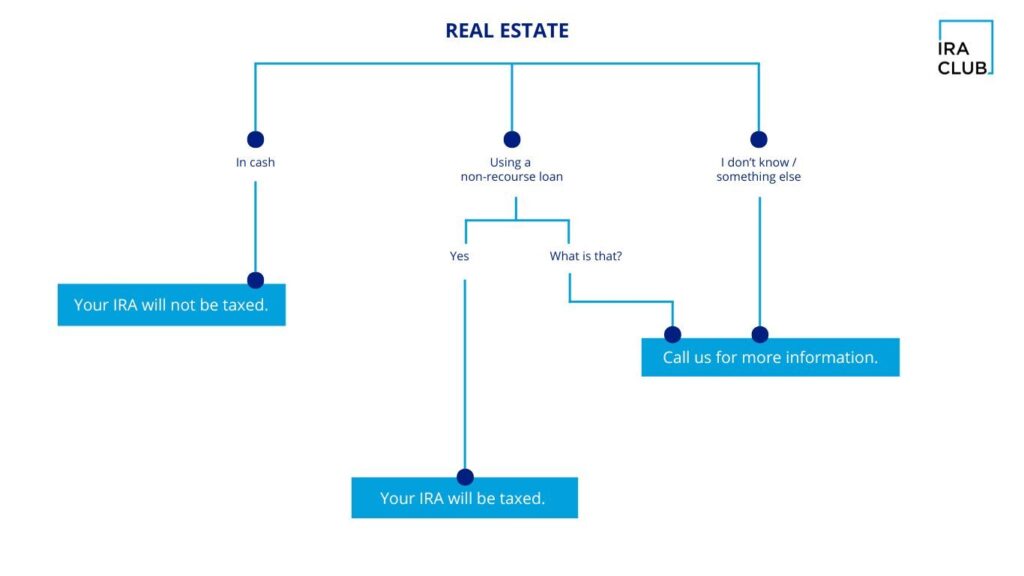

Learn how the receipt of unrelated business taxable income (UBTI) could require payment of income tax.

About King Operating Partners

Meet The Experts

KING OPERATING PARTNERS

Jay R. Young

Jay R. Young is the Founder and CEO of King Operating Corporation, headquartered in Addison, Texas. Jay earned his Bachelor of Business Administration (BBA) degree from Angelo State University.

His journey started with various roles that eventually led to the establishment of King Operating Corporation in October 1996. Prior to establishing King, Jay gained experience with roles in both finance and the oil and gas industry. He served as Vice President at Texakoma Oil and Gas Corp., worked with stocks and commodities as a Vice President at Dillon Gage, and traded stocks at World Market Equities. Additionally, he has been a member of Tiger 21 since 2011 and was a former minority owner of the World Series Champion Texas Rangers.

With over two decades of experience, Jay has earned a reputation for his strategic foresight and entrepreneurial leadership in the energy sector. He is also the Amazon #1 best-selling author of “The Upside of Oil and Gas Investing,” a Forbes Books publication that shares his deep insights into the industry.

In addition to his professional accomplishments, Jay is deeply committed to philanthropy. He serves on the executive board of Scouting America, where he mentors emerging leaders. He also contributes his time to the North Central Texas Chapter of the Alzheimer’s Association, actively promoting Alzheimer’s research and support services and serves as a board member for Nancy Lieberman Charities.

Jay’s philanthropic efforts extend beyond these organizations; he is an active member of his church, he is also involved in various other charities, reflecting his dedication to giving back to the community. His involvement underscores his belief in corporate responsibility and making a positive impact beyond his business.

Vice President of IRA Club

Ramez Fakhoury

As an entrepreneur with a rich background spanning over two decades, Ramez is deeply commited to education and inspiring individuals, empowering them to venture beyond conventional paths and diversify their investments through the power of self-direction.

IRA Club Benefits

FDIC Insured

IRA/401(k) cash is FDIC insured

Flat Fee Structure

Flat fees and straightforward pricing

Free IRA Reports

Free annual IRA tax reporting

(RMDs, 1099-R, 5498, 5500 forms)

Investor's Row

Explore alternative investment opportunities

Concierge Service

Friendly, white-glove service

Educational Resources

Up-to-date educational resources on IRS regulations

Frequently Asked Questions

Here are the most common Self-Directed IRA questions. Have others?

Sign up for our webinar and ask us in person!

IRA Club provides a way for people like you to fully utilize the benefits of Self-Directed IRAs, leading to a wider range of investments and potential for better returns.

It’s an IRA that gives you more choices for where you want to invest your money, not just in regular stocks or bonds.

Self-Directed IRAs were passed by Congress back in 1974. Alternative IRA investments have always been allowed by the IRS, however, many IRA companies have placed artificial restrictions on IRA owners over the years. Self-Directed IRAs are not well known because most banks and brokerage firms prefer traditional investments.

It’s easy to make investments with a Self-Directed IRA. Once you find your investment and provide money to the seller, you will receive proof that your Self-Directed IRA is the new owner. It can be in the form of a Bill of Sale, title, deed, or simply a statement identifying your Self-Directed IRA as the asset’s new owner. The main difference is that the name on the title (or other documents) is the name of your Self-Directed IRA and not your name as an individual.

Maximum Contributions for 2025:

Under age 50 – $7,000.

Age 50 and over – $8,000