Can My IRA Invest in a Business?

YES. A Self Directed IRA may invest in a business: Self Directed IRA investments in a business may be in one of the following two forms:

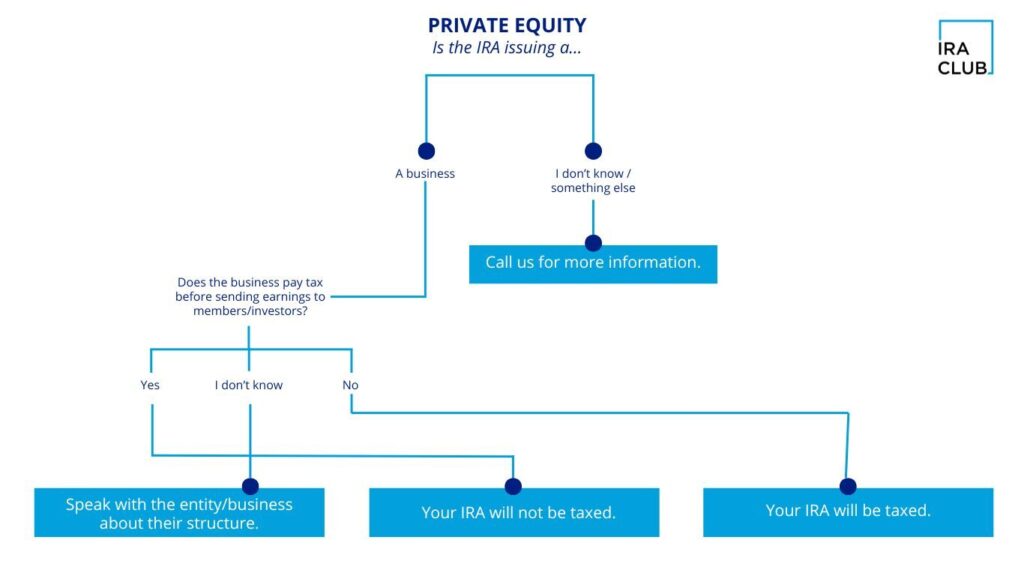

- An equity investment (Sometimes called a “private placement”) In this case your IRA will receive units of ownership and the return to your IRA will be based on the earnings of the business.

- A loan from your IRA. In this case your IRA will receive a promissory note. The promissory note will state a rate of interest and the terms of the payback to the IRA.

Your IRA may invest in almost any business. However, there are a very few “prohibited transactions;” these are the businesses that your IRA may not invest in.

If any of the following are present, your IRA may NOT invest in that company. Outside of this short list of prohibitions, most business investment allowed.

If any of the following own 50% or more of the company

| The IRA owner | Or an entity controlled by this person | |

| The IRA owner’s | Parents or grandparents | Or an entity controlled by any of these |

| The IRA owner’s | Children or grandchildren | Or an entity controlled by any of these |

| The IRA owner’s | Spouse or descendants | Or an entity controlled by any of these |

(Examples of a Sr. Manager would be: President, Vice President etc.) If any of the following function as an executive or Sr. Manager are being performed by:

| The IRA owner | Or an entity controlled by this person | |

| The IRA owner’s | Parents or grandparents | Or an entity controlled by any of these |

| The IRA owner’s | Children or grandchildren | Or an entity controlled by any of these |

| The IRA owner’s | Spouse or descendants | Or an entity controlled by any of these |

In general, although your IRA may invest in almost any business, your IRA may not invest in your business.

For information about the Self Directed IRA or Solo 401k, call IRA Club at 312-795-0988

IRA Club offers no investments, products, or planning services. Therefore, please consult your attorney, tax professional, financial planner, and any other qualified person before making any investments.