AI-Powered Investing for Smarter Retirement Planning

Discover how iFlip's advanced AI technology can protect your portfolio and maximize your returns with minimal effort.

- Risk Management: Minimize your exposure to market downturns.

- Performance: Achieve better returns through AI-driven strategies.

- Transparency: No hidden fees, just clear subscription-based pricing.

- Flexibility: Change your strategy or withdraw anytime with ease.

Let Us Guide You

Talk with our team

Founded

In 2008

Members

Administered

1 Billion

in Assets

Full-Time

Dedicated Staff

White

Glove Service

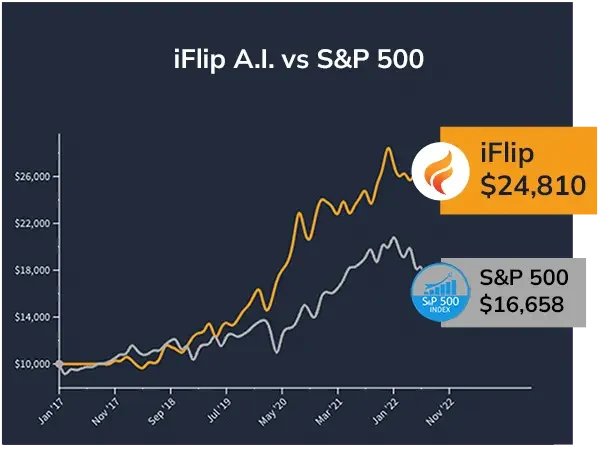

An A.I.-powered investing platform that outperforms the S&P 500 and protects you when the market crashes.

iFlip A.I. since 2017

So how does it work?

-

Our proprietary A.I. analyzes the market daily.

-

It identifies trend changes or upcoming crashes.

-

We rebalance your portfolio in real-time without you having to lift a finger.

-

Our A.l. constantly improves as more market data is collected.

IRA Club and iFlip have your back.

Learn about our two latest Smartfolios for 2024

SHIELD+

The SHIELD+ SmartFolio is designed to help protect your investment in times of persistent high inflation.

Shield+ fits seamlessly into a well-planned diversification strategy, because it’s built with investments and strategies that are resilient to downturns in the stock market.

BitFlip

The BitFlip Smartfolio provides you the upside of bitcoin ETFs while leveraging our proven A.I. to manage the risk.

Bitcoin and crypto have incredible potential but they are also highly volatile. Now you can take advantage of the highs and protect yourself from the lows of crypto assets.

Testimonials

“Working with the IRA Club has been a great experience. They are professional, competent, and responsive. I have appreciated the communication and help with their platform. I highly recommend them."

Largo, Florida

"I have received excellent service and attention from the staff at IRA Club. From the moment that I was introduced to them as an organization and all the way through the process of getting my accounts funded, they have been extremely responsive and an organization that I have recommended to several friends and family."

Chicago, Illinois

"IRA CLUB is everything I was hoping for and more. They helped make the property sale, 401k transfer, and the entire transaction flawless! You'll likely talk to various IRA CLUB reps, but each one had a role and they executed flawlessly. Thank you for making my first IRA CLUB experience perfect."

Miami, Florida