OCTOBER 6-8th, 2024

Experience the ultimate real estate event at BPCON2024 in Cancun! Network with industry influencers and thousands of fellow investors, dive into top-notch content, and witness deals being made in the corridors. This year, it’s not just about business – it’s an immersive, all-inclusive getaway, starting at just $1270 per person, including accommodations for 3 nights, ALL food and drinks, and your conference pass.

Founded

In 2008

Members

Administered

1 Billion

in Assets

Full-Time

Dedicated Staff

White

Glove-Service

Frequently Asked Questions

Here are the most common Self Directed IRA questions. Have others?

Sign up for our webinar and ask us in person!

IRA Club provides a way for people like you to fully utilize the benefits of Self-Directed IRAs, leading to a wider range of investments and potential for better returns.

It’s an IRA that gives you more choices for where you want to invest your money, not just in regular stocks or bonds.

Self-Directed IRAs were passed by Congress back in 1974. Alternative IRA investments have always been allowed by the IRS, however, many IRA companies have placed artificial restrictions on IRA owners over the years. Self-Directed IRAs are not well known because most banks and brokerage firms prefer traditional investments.

It’s easy to make investments with a Self-Directed IRA. Once you find your investment and provide money to the seller, you will receive proof that your Self-Directed IRA is the new owner. It can be in the form of a Bill of Sale, title, deed, or simply a statement identifying your Self-Directed IRA as the asset’s new owner. The main difference is that the name on the title (or other documents) is the name of your Self-Directed IRA and not your name as an individual.

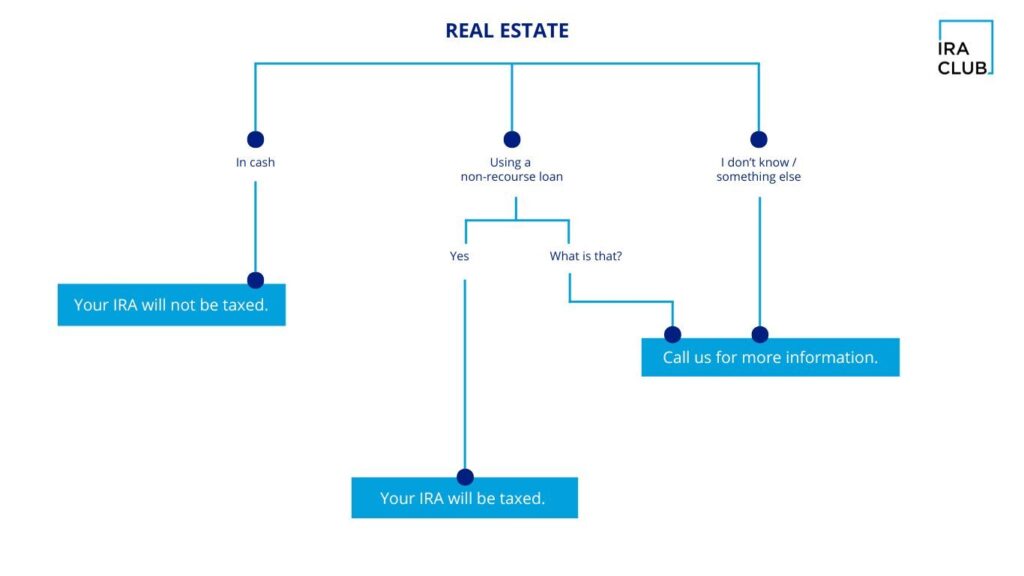

Yes. The most common way for an IRA to buy an asset is to pay cash. However, there may be times when an alternative method of payment is practical.

Maximum Contributions for 2023:

Under age 50 – $7,000.

Age 50 and over – $8,000