360 REAL ESTATE UNIVERSITY (REU)

March 6th, 2025 1:00 PM CT

Jacqueline Matoza

Ramez Fakhoury

As a thank you for joining this webinar, you’ll receive 50% off your virtual or in-person ticket to Jacqueline's Real Estate Wealth Summit in October.

March 6th, 2025 1:00 pm ct

Founded

In 2008

Members

Administered

1 Billion

in Assets

Full-Time

Dedicated Staff

White-Glove

Service

Here’s What You’ll Learn

1

2

3

How To Mitigate, Manage, and Multiply Your Wealth

4

Meet The Experts

360 REAL ESTATE UNIVERSITY (REU)

Jacqueline Matoza

Meet Jacqueline!

I make the MOST millionaires possible!

It's long been Jacqueline's dream to retire from her Certified Public Accountant (CPA) and give back. As an International Tax Director and CPA since 2006, Jacqueline has advised the top companies analyzing financial statements and global operations to identify areas of opportunity to save taxes in every business. This training helped Jacqueline gain a detailed understanding of how businesses and money work.

After working this high profile job with the richest in the US, Jacqueline knew so many small businesses were struggling through COVID-19 that it was time to stop being part of the problem and become the solution by sharing her knowledge to help others reach their dreams and fix their finances once and for all. She wants to be one of the few to truly help others achieve financial and business success, so they can be financially free!

Jacqueline has been a real estate investor since 2007, while working her CPA day job. She launched a house flipping business in 2018. Her financial background helps her ensure investments are sound and profitable - this is what makes her so unique! Her passion lies in designing homes, but saw first hand from her wealthy clients that real estate is one of the most sound investments anyone can make to build wealth given real estate is often not taxed and it tracks cost of living!

Vice President of IRA Club

Ramez Fakhoury

As an entrepreneur with a rich background spanning over two decades, Ramez is deeply commited to education and inspiring individuals, empowering them to venture beyond conventional paths and diversify their investments through the power of self-direction.

FDIC Insured

IRA/401(k) cash is FDIC insured

Flat Fee Structure

Flat fees and straightforward pricing

Free IRA Reports

Free annual IRA tax reporting

(RMDs, 1099-R, 5498, 5500 forms)

Investor's Row

Explore alternative investment opportunities

Concierge Service

Friendly, white-glove service

Educational Resources

Up-to-date educational resources on IRS regulations

Frequently Asked Questions

Here are the most common Self-Directed IRA questions. Have others?

Sign up for our webinar and ask us in person!

IRA Club provides a way for people like you to fully utilize the benefits of Self-Directed IRAs, leading to a wider range of investments and potential for better returns.

It’s an IRA that gives you more choices for where you want to invest your money, not just in regular stocks or bonds.

Self-Directed IRAs were passed by Congress back in 1974. Alternative IRA investments have always been allowed by the IRS, however, many IRA companies have placed artificial restrictions on IRA owners over the years. Self-Directed IRAs are not well known because most banks and brokerage firms prefer traditional investments.

It’s easy to make investments with a Self-Directed IRA. Once you find your investment and provide money to the seller, you will receive proof that your Self-Directed IRA is the new owner. It can be in the form of a Bill of Sale, title, deed, or simply a statement identifying your Self-Directed IRA as the asset’s new owner. The main difference is that the name on the title (or other documents) is the name of your Self-Directed IRA and not your name as an individual.

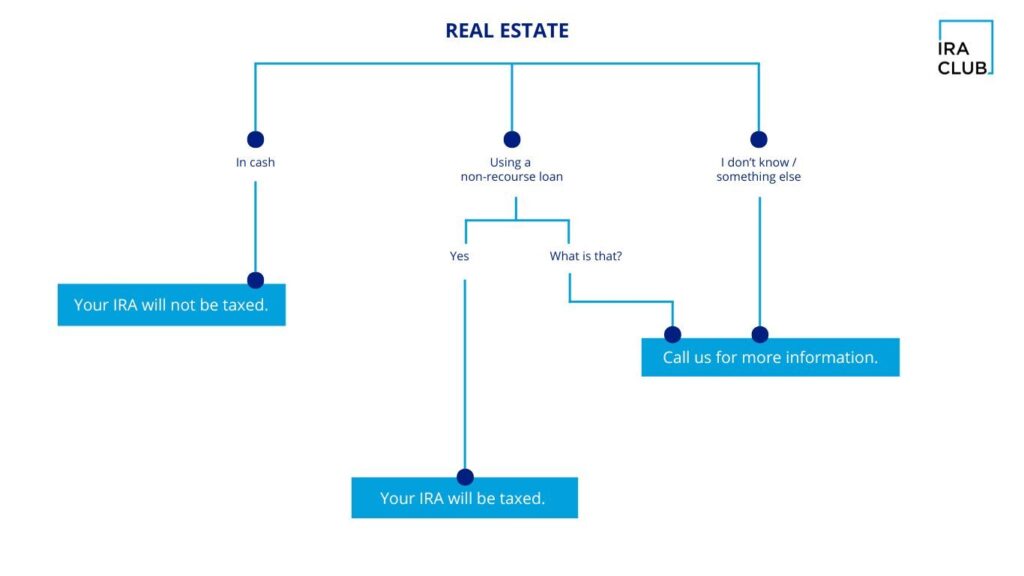

Yes. The most common way for an IRA to buy an asset is to pay cash. However, there may be times when an alternative method of payment is practical.

Maximum Contributions for 2023:

Under age 50 – $7,000.

Age 50 and over – $8,000