Everything at IRA Club is designed to make investing in alternatives easier. We have a flat fee model, process investments quickly, and help you stay compliant.

ALTERNATIVE OPTIONS

Exciting investment opportunities.

Discover exciting ways to grow your retirement savings. IRA Club empowers you to invest your retirement account in diverse assets like rental real estate, private placements, precious metals, and much more.

Explore opportunities

Investor's Row has just some of the thousands of opportunities a Self-Directed account may invest in.

A good rule of thumb

Direct access

Build your knowledge

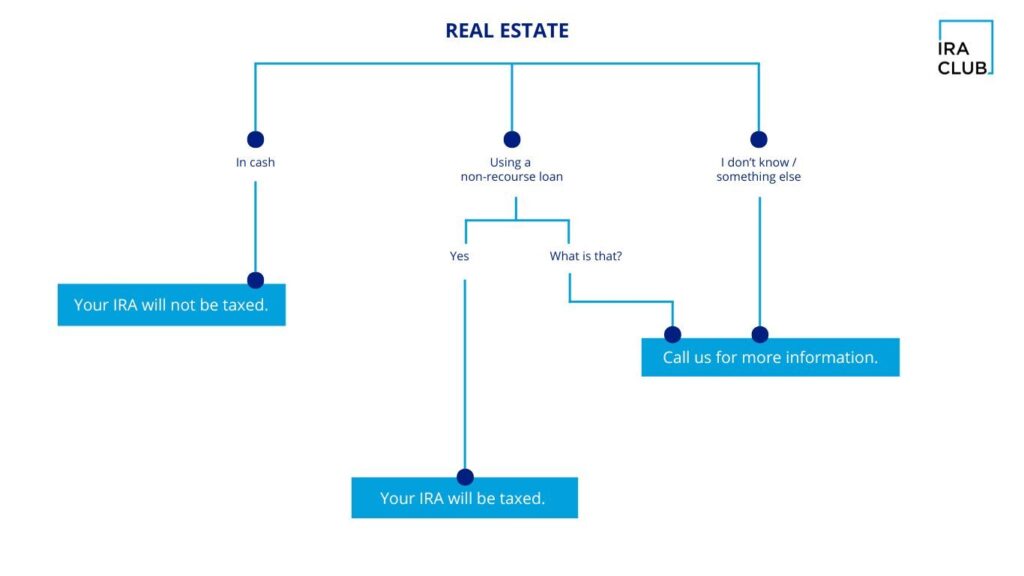

- Real Estate

- Apartments

- Fix and Flip

- Oil and Gas

- Cryptocurrencies

- Pre-IPO

- Private Lending

Transfer funds from an IRA at another firm.

IRA Club will request this transfer on your behalf.

Rollover a previous employer plan.

If you had a 401(k), 403b or TSP through your old employer, our team will walk you through the rollover process. Processing times may vary.

Make an annual contribution.

Start a brand new account with a contribution and add funds each year. Make sure to double-check your contribution limit.

A Self-Directed IRA allows you to choose your own investments. Please don’t hesitate to contact IRA Club for assistance to ask a compliance question. Need inspiration? We invite you to explore and do some research on Investor’s Row!

The future is .

Unlock potentially more profitable investments for your retirement through an IRA Club Self-Directed plan. This approach offers greater investment flexibility compared to traditional brokerage IRAs, all while being structured to provide some of the lowest annual fees and charges available.

-

Minimum Balance to Start $500

-

Performance Fees 0%

-

Income Tax 0%

-

Capital Gains $0

ALWAYS INCLUDED

Member Benefits

- Personal account specialist

- Strategies for small business owners

- Access to exclusive resources

- Allowable transaction review

- Annual report filing to the IRS

- Members only webinars on investing

They know the latest on every nuance and innovation in retirement planning. Highly recommend.

Eric F., March 2024

Member since 2022

There was a high degree of professionalism and responsiveness in all my interactions with the company's staff. They helped me transfer some of my IRA funds to a self-directed IRA, and so far it seems to have gone through without any problems, so I'm very satisfied. A special shout-out to Emily Johnson who helpfully and professionally answered my several calls about the transfer.

Laura O., February 2024

Member since 2021

In a day and age where many businesses use email as a crutch, IRA Club uses it effectively, but is more than willing to hop on a phone call with us. Their patience with explaining every detail to us is impressive and greatly appreciated. The service is among the best of any company I've worked with.

Noel, Carlos, and everyone else at IRA Club have been a delight to work with. Thank you!

Nathan B.

Member since 2016

The customer service at the IRA Club is outstanding. It is so exceptional that I am continually pleasantly surprised. Catherine Tucker opened my accounts and followed up on all required transfers. For self directed IRAs I think this is the best company to work with. All of my questions have been promptly answered by competent members of the team. They really deserve a 10 star rating!

Sue S.

Member since 2023

The IRA Club offers exceptional customer service. They are also a delight to work with. Without the help and support of Catherine & Carlos the investments I designated to be transferred to IRA Club would not have been done in a timely manner & may have cost me penalties and fees. They are detailed, quick to respond, and knowledgeable. I would highly recommend IRA Club to any investor!!

Lynn C.

Member since 2023

IRA CLUB is everything I was hoping for and more. They helped make the property sale, 401k transfer, and the entire transaction flawless! You'll likely talk to various IRA CLUB reps, but each one had a role and they executed flawlessly. Thank you, for making my first IRA CLUB experience perfect!

Sig D

Member since 2022

“You are truly outstanding!!

Your superior follow-up and excellent customer service is beyond expectation. You are one of a kind!!!”

Rick

Member since 2019

“IRA Club provides prompt response and great customer service from start to finish with any transaction I have done with them.”

Alberto

Member since 2023

“Straightforward, knowledgeable and helpful.”

Suzi

Member since 2020

Charity Support

IRA Club is a proud to support Wounded Warrior Project® (WWP). Over the years, we’ve had the privilege of meeting many inspiring veterans who have shared their stories of resilience, courage, and dedication. To honor their sacrifices and continue supporting their journey, we donate a portion of our profits to WWP, helping provide essential resources and services to wounded veterans and their families.

We understand that many of our clients establish retirement funds not only to secure their own future but also to provide for their children. This commitment to loved ones reflects the values we hold dear. Children bring so much joy to our lives, and we believe in sharing that joy. That’s why we’re proud to support Make-A-Wish, an organization dedicated to creating magical moments and lasting happy memories for children and their families.

Self-Directed IRA FAQ

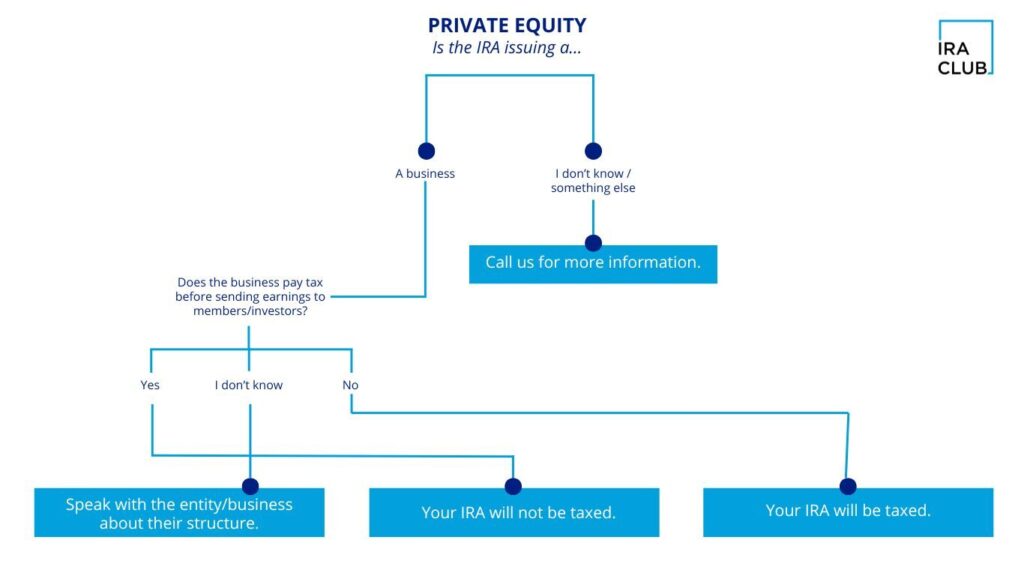

A Self-Directed IRA (SDIRA) broadens the types of assets you can hold in a tax-advantaged retirement account. Unlike traditional IRAs, which usually contain publicly traded securities, an SDIRA allows for alternative assets like real estate, private equity, and IRS-approved precious metals. This structure allows individuals to select from a broader range of IRS-permitted assets, depending on their preferences and understanding of how each asset type operates, all while following IRS rules.

SDIRAs follow the same IRS contribution limits as all IRAs—$7,000 for 2025 and $7,500 for 2026. If you’re age 50 or older, catch-up contributions are $1,000 in 2025 and $1,100 in 2026. Understanding these limits is important for maintaining IRS compliance. Rollovers and transfers have separate IRS rules and don’t count against your annual contributions. SDIRAs also require careful focus on custodial oversight, prohibited transactions, and asset-specific rules.

A qualified IRA custodian or administrator holds the SDIRA assets and handles IRS reporting.

This guide offers a clear overview of how Self-Directed IRAs work, the rules that apply, and the administrative steps required. Understanding these elements can help individuals understand how an SDIRA operates and how it differs from traditional IRA structures.

A Self-Directed IRA (SDIRA) is a retirement account that allows certain alternative assets. This differs from standard IRAs, which typically hold publicly traded securities. Depending on the custodian, an SDIRA can hold real estate, private equity, promissory notes, and IRS-approved precious metals. These accounts follow the same IRS contribution rules as other IRAs:

- Annual limit: $7,000 for 2025 and $7,500 for 2026

- Catch-up contributions: $1,000 in 2025 and $1,100 in 2026 for individuals aged 50 or older

Rollovers and transfers have their own IRS rules and do not count toward these limits.

Unlike brokerage-directed IRAs, an SDIRA places alternative investment-direction responsibilities on the account holder, consistent with IRS requirements. Since these accounts can hold non-publicly traded assets, SDIRAs must follow IRS rules on prohibited transactions, valuation, and custodial oversight.

A qualified IRA custodian or administrator manages the SDIRA assets and handles IRS reporting, including Forms 5498 and 1099-R.

Takeaway:

A Self-Directed IRA holds certain alternative assets within an IRA’s existing tax framework. It follows the same IRS contribution limits and custodial rules as other IRAs. Understanding the rules for custody, reporting, and allowed asset types is key when evaluating whether an SDIRA aligns with your overall retirement approach.

A Self-Directed IRA (SDIRA) follows the same IRS contribution limits, tax rules, and distribution requirements as Traditional or Roth IRAs. For 2025, the annual contribution limit is $7,000 and $7,500 in 2026. Those age 50 or older can make catch-up contributions of $1,000 in 2025 and $1,100 in 2026. Rollovers and transfers have separate IRS rules and do not count toward these limits. There is no legal difference between a self-directed IRA and an IRA. They are all federally regulated. A self-directed IRA can be Traditional or Roth.

A key difference involves the types of assets the account may hold and the level of investment direction required from the account holder. Standard IRAs usually invest in publicly traded securities like stocks, bonds, and mutual funds. However, an SDIRA may hold certain alternative assets, depending on the custodian’s permitted asset types and IRS regulations. Examples include real estate, private equity, promissory notes, and IRS-approved precious metals, when permitted by the custodian and compliant with IRS rules.

Because SDIRAs may involve non-publicly traded assets, they require careful adherence to IRS rules, documentation standards, and due diligence. A qualified IRA custodian or administrator holds the assets, maintains records, and provides IRS reporting, including Forms 5498 and 1099-R.

Takeaway:

A Self-Directed IRA differs from Standard IRAs by allowing certain alternative assets while keeping the same IRS contribution limits and tax rules. Understanding custodial requirements, prohibited transaction rules, and asset-specific responsibilities is key when evaluating whether an SDIRA aligns with your retirement strategy and regulatory requirements.

A Self-Directed IRA (SDIRA) can hold alternative assets that are not typically available in IRAs at a public custodian. Common examples include real estate, private equity, promissory notes, and certain approved precious metals under Internal Revenue Code §408(m). Some custodians may also allow certain niche asset types, such as tax liens, provided they comply with IRS rules and do not involve prohibited transactions.

SDIRAs share the same contribution limits as all IRAs:

- Annual limit: $7,000 for 2025 and $7,500 for 2026

- Catch-up contributions: $1,000 in 2025 and $1,100 in 2026 for those aged 50 or older

Rollovers and transfers have different IRS rules and do not count toward the annual limits.

Since SDIRAs can hold non-publicly traded assets, they need careful documentation, valuation, and IRS compliance. A qualified IRA custodian or administrator holds the assets, maintains records, and issues tax forms.

Takeaway:

A Self-Directed IRA can hold alternative assets if allowed by the custodian and compliant with IRS rules. Understanding eligibility, custodial requirements, and administrative responsibilities can help individuals evaluate whether certain asset types fit within their retirement strategy.

A Self-Directed IRA (SDIRA) offers more asset options than a standard IRA. However, IRS rules limit what can be included. According to Internal Revenue Code §408 and §4975, certain assets are not allowed. Specific activities, called “prohibited transactions,” can disqualify the IRA and have it distributed at face value to the IRA owner.

Assets Not Permitted in an SDIRA

The IRS prohibits the following in SDIRAs:

- Collectibles, like artwork, rugs, antiques, stamps, most coins, alcoholic beverages, and some gems.

- Life insurance contracts are not eligible investments for IRAs.

- S-corporation shares.

Prohibited Transactions

Even permitted assets can lead to violations. A prohibited transaction happens when the SDIRA engages in actions that benefit directly or indirectly a “disqualified person,” such as:

- The account holder

- The account holder’s spouse

- Lineal descendants or ascendants (children, parents, grandparents)

- Entities owned or controlled by any disqualified person

Examples of prohibited transactions can include personal use of SDIRA-owned property, selling personal assets to the SDIRA, or extending credit between the SDIRA and a disqualified person. These are governed by IRS rules under §4975. Such actions may cause the IRS to treat the entire IRA as distributed as of the first day of the year in which the violation occurred, which can create significant tax consequences.

IRA Club includes prohibited transaction analysis as a member benefit to all IRA Club members.

Takeaway:

SDIRAs cannot hold collectibles, life insurance, or assets that do not meet IRS eligibility. A clear understanding of prohibited transactions and disqualified persons helps maintain the tax-advantaged status of the account. Review asset eligibility with your custodian or a qualified tax professional to ensure the investment meets IRS requirements.

A Self-Directed IRA (SDIRA) allows you to invest in options outside of the stock market. An SDIRA can include real estate, private equity, promissory notes, and IRS-approved precious metals, and more. This variety allows individuals to diversify beyond publicly traded securities, which may behave differently across market conditions.

SDIRAs follow the same IRS contribution limits as all IRAs:

- Annual contribution limit: $7,000 for 2025 and $7,500 for 2026

- Catch-up contributions: $1,000 in 2025 and $1,100 in 2026 for individuals age 50 or older

Rollovers and transfers have different IRS rules and don’t count toward annual contribution limits.

Because SDIRAs can hold non-publicly traded assets, they require careful attention to IRS rules on prohibited transactions, valuation, documentation, and custodial oversight. A qualified IRA custodian or administrator holds the SDIRA assets, keeps records, and issues required IRS forms like Forms 5498 and 1099-R.

Takeaway:

A Self-Directed IRA offers access to alternative assets not found in most traditional retirement accounts. Its potential advantages include broader diversification and the ability to choose asset types that align with personal experience, while still following the same IRS contribution limits, tax rules, and custodial requirements that apply to all IRAs.