Diversify Your Retirement with a Tax-Advantaged Investment Account

A Self-Directed IRA gives you more choices for where you want to invest your retirement savings, not just in stocks or bonds.

- Flat Fee structure means more money in your pocket

- No federal income tax or federal tax filing on the growth of your investment

- Traditional, Roth, SEP and SIMPLE IRAs can be Self-Directed

- Free annual IRA tax reporting

- Flexibility to invest in alternative assets

Let Us Guide You

Talk with our team

Founded

In 2008

Members

Administered

1 Billion

in Assets

Full-Time

Dedicated Staff

White

Glove Service

Frequently Asked Questions

IRA Club provides a way for people like you to fully utilize the benefits of Self-Directed IRAs, leading to a wider range of investments and potential for better returns.

It’s an IRA that gives you more choices for where you want to invest your money, not just in regular stocks or bonds.

Self-Directed IRAs were passed by Congress back in 1974. Alternative IRA investments have always been allowed by the IRS, however, many IRA companies have placed artificial restrictions on IRA owners over the years. Self-Directed IRAs are not well known because most banks and brokerage firms prefer traditional investments.

It’s easy to make investments with a Self-Directed IRA. Once you find your investment and provide money to the seller, you will receive proof that your Self-Directed IRA is the new owner. It can be in the form of a Bill of Sale, title, deed, or simply a statement identifying your Self-Directed IRA as the asset’s new owner. The main difference is that the name on the title (or other documents) is the name of your Self-Directed IRA and not your name as an individual.

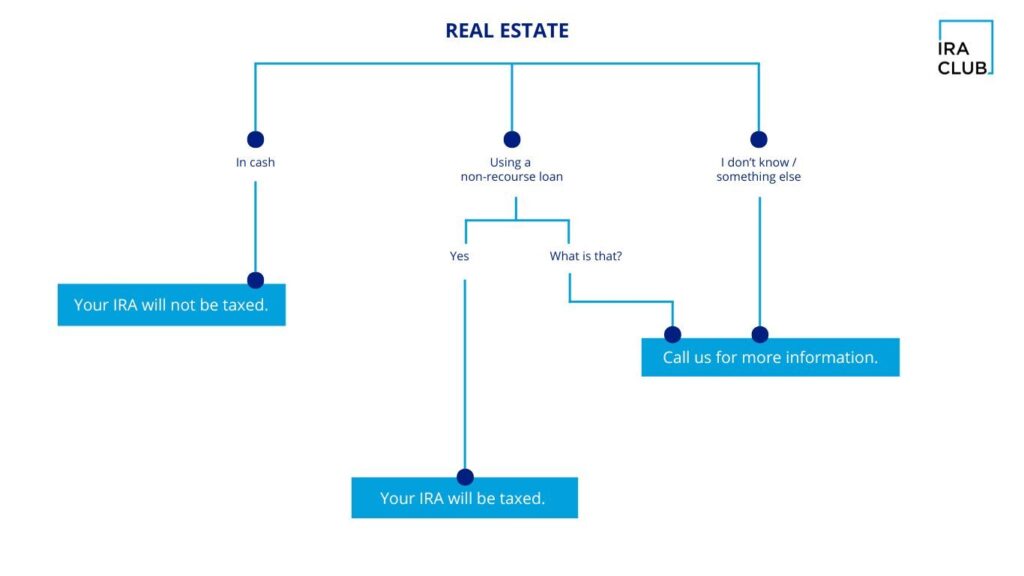

Yes. The most common way for an IRA to buy an asset is to pay cash. However, there may be times when an alternative method of payment is practical.

Maximum Contributions for 2024:

Under age 50 – $7,000

Age 50 and over – $8,000

IRA Club Benefits

FDIC Insured

Flat Fee Structure

Free IRA Reports

Investor's Row

Concierge Service

Educational Resources

Here’s What You’ll Learn

Investor’s Row

Investor’s Row is an educational platform that offers a variety of asset classes. Once your account is open and funded, you can start selecting investments. Remember to perform your due diligence and invest in what you know and understand best. Then, make the most of your retirement funds by reaching out to one of the experts to learn more about each offering. To get started, simply click on the company you’re interested in to schedule a one-on-one consultation.

Need Inspiration On Your Next Investment?

Testimonials

“Working with the IRA Club has been a great experience. They are professional, competent, and responsive. I have appreciated the communication and help with their platform. I highly recommend them."

Largo, Florida

"I have received excellent service and attention from the staff at IRA Club. From the moment that I was introduced to them as an organization and all the way through the process of getting my accounts funded, they have been extremely responsive and an organization that I have recommended to several friends and family."

Chicago, Illinois

"IRA CLUB is everything I was hoping for and more. They helped make the property sale, 401k transfer, and the entire transaction flawless! You'll likely talk to various IRA CLUB reps, but each one had a role and they executed flawlessly. Thank you for making my first IRA CLUB experience perfect."

Miami, Florida

What constitutes an accredited investor?

$250k individual income, $300k joint, or $1MM in total assets

7e Investments

Alpine Capital Solutions

AXIUM WEALTH

Bequest Asset Management

Boxabl Inc.

Braeburn Whisky, Inc.

Elevate CIG LLC

Energy Exploration Technologies, Inc.

FideliTrade Incorporated

Flip Investor Inc

GoldCore

Hearthfire Holdings

King Operating Partners

Kirkland Capital Group

Legacy Land Fund

Life Asset

Marshall Reddick Real Estate

MF Capital Partners LLC

MJ Real Estate Investment Trust

Mode Mobile

PFD Management LLC

Phoenix Energy

Pioneer Realty Capital

PPR Capital Management

Proxy Financial Corp

Rent to Retirement

Spartan Investment Group

Stallion Capital Management

Texas Notes

The Mid Atlantic Secured Income Fund

TradeBacked

VCapital Management

Viking Capital