Transform Your Approach to Real Estate Investing, Retirement, and Asset Protection

This live event will cover everything from property acquisition and rehabilitation to effective property management and tenant screening. Aaron Adams and his team will equip you with both passive and active strategies, whether you’re looking to start a side hustle in real estate investing or jump in with both feet full time!

- August 9-11th – Indianapolis, IN

- September 13-15th – Idaho Falls, ID

- October 11-13th – Idaho Falls, ID

- November 15-17th – Indianapolis, IN

Aaron Adams

Ramez Fakhoury

Dennis Blitz

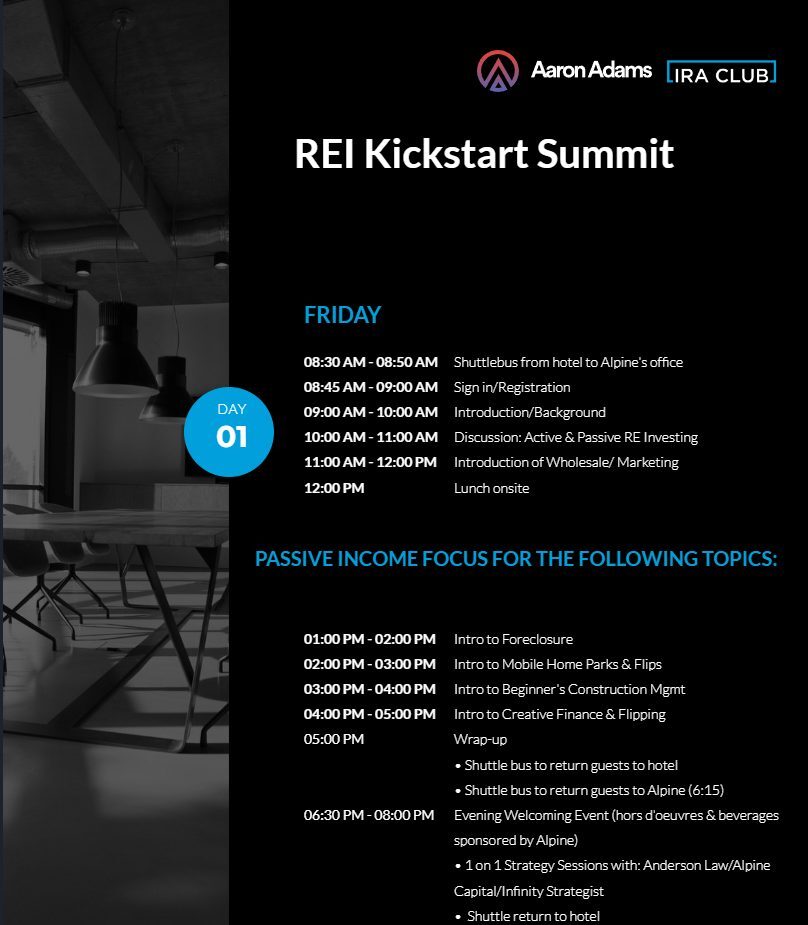

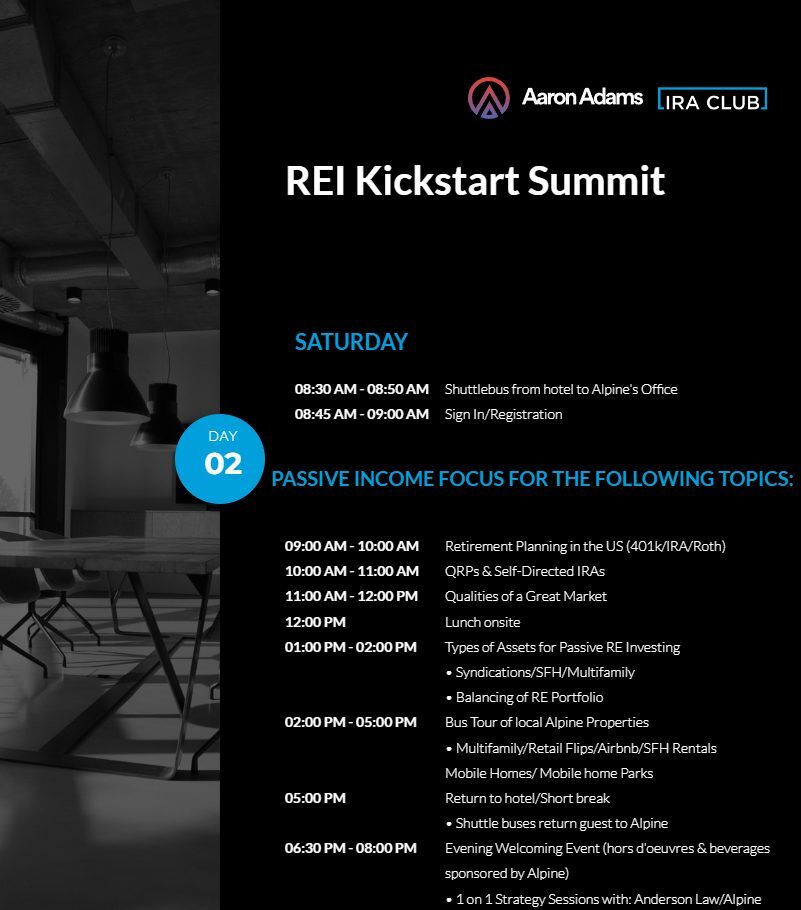

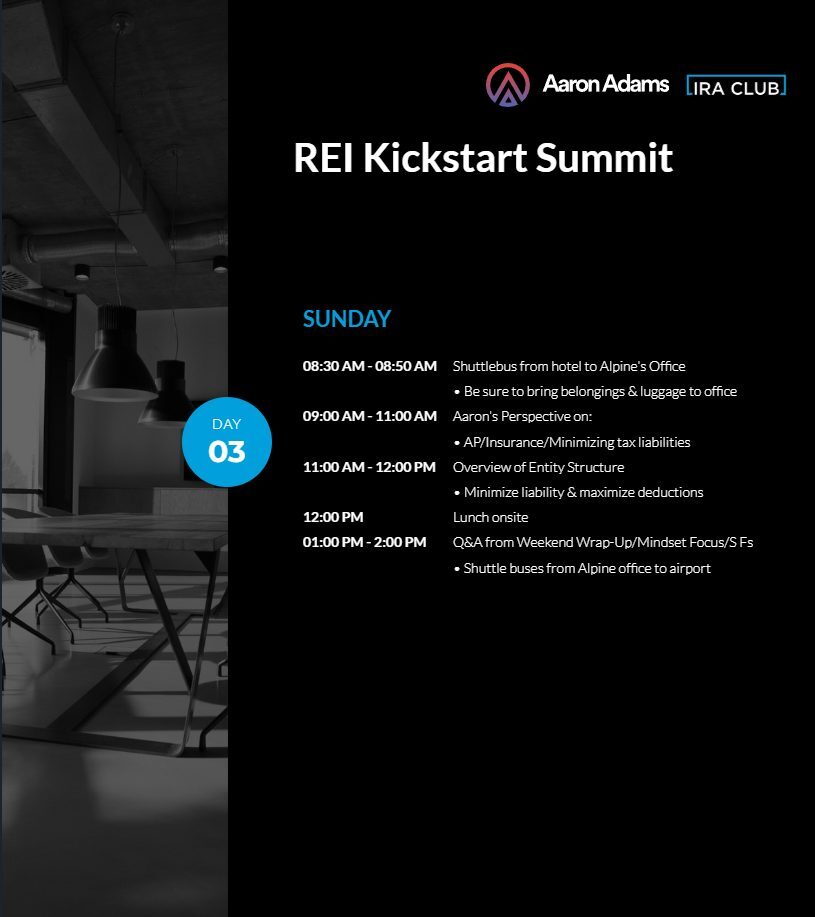

Itinerary

Here’s What You’ll Learn

Turnkey Investing

Airbnb & Mobile Home Investing

Self-Directed Retirement

Tax Strategies

Types of Asset Protection

In Person Property Tours

Meet The Experts

CEO & FOUNDER OF ALPINE CAPITAL

Aaron Adams

He is currently the CEO of Alpine Property Management and Alpine Capital Solutions, as well as managing partner in a private equity firm and managing partner of several dozen companies.

Vice President OF ira club

Ramez Fakhoury

As an entrepreneur with a rich background spanning over two decades, Ramez is deeply commited to education and inspiring individuals, empowering them to venture beyond conventional paths and diversify their investments through the power of self-direction.

President of ira club

Dennis Blitz

Dennis is a Self-Directed IRA, Solo 401(k), and Health Savings Account professional, active writer and speaker on the topic of Self-Directed IRAs, he monitors legislative actions relating to IRAs, Individual 401(k)s & HSAs, and is passionate about helping people just like you earn more.

*Space is limited. All attendees must pre-qualify to join the free live event. Additional cost may apply for additional attendees.